Latest

The Real-World Assets (RWA) Opportunity: Hype vs. Durable Value

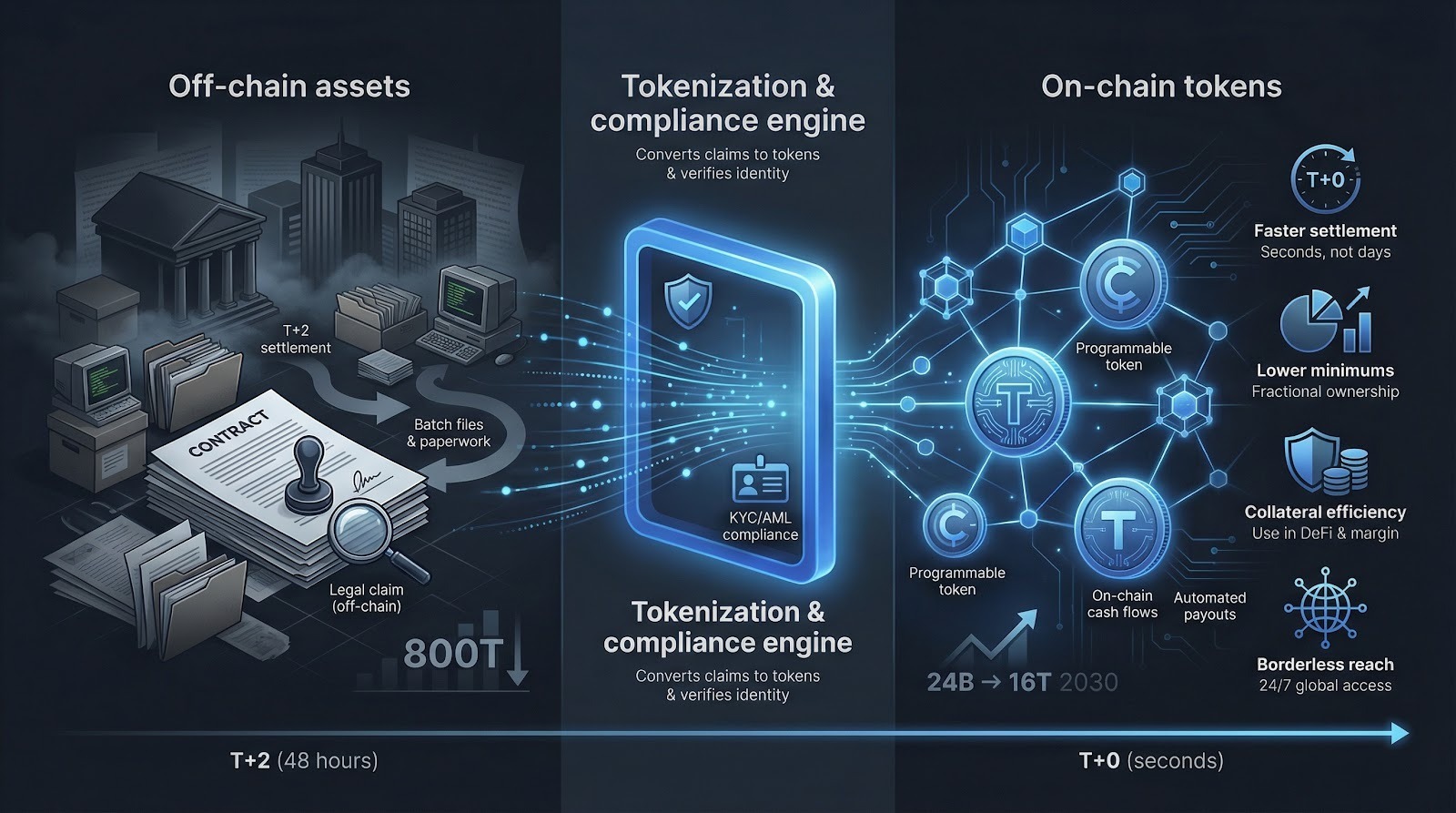

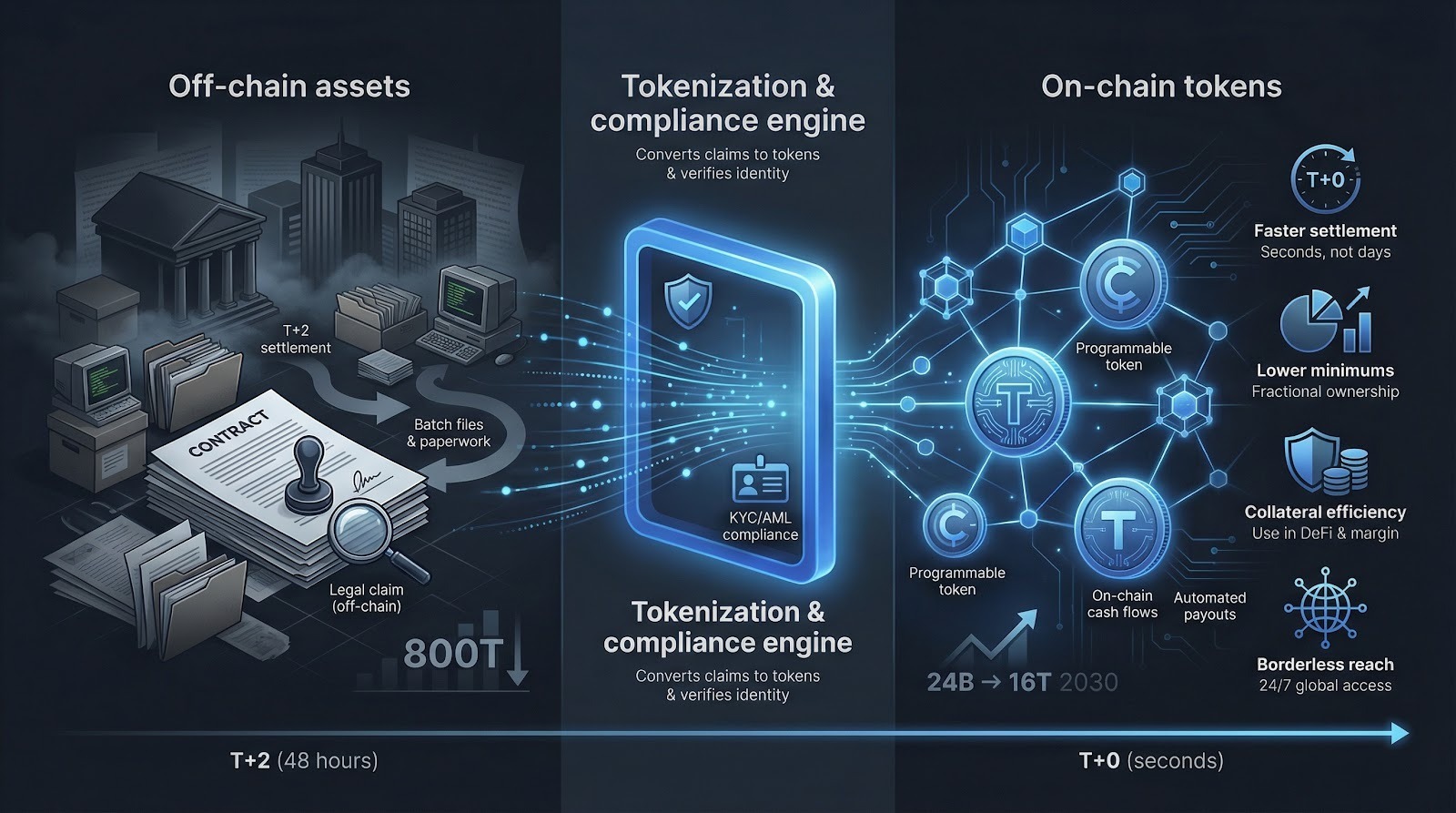

Tokenized real-world assets, or RWAs, are popping up in marketing decks, keynote slides, and investor memos. Polymesh estimates that more than USD 800...

%20lands%20$7M%20Seed%20to%20launch%20a%20global%20professional%20dance%20league.png)