Latest

The Role of Financial Technology (FinTech) in Modern Fundraising

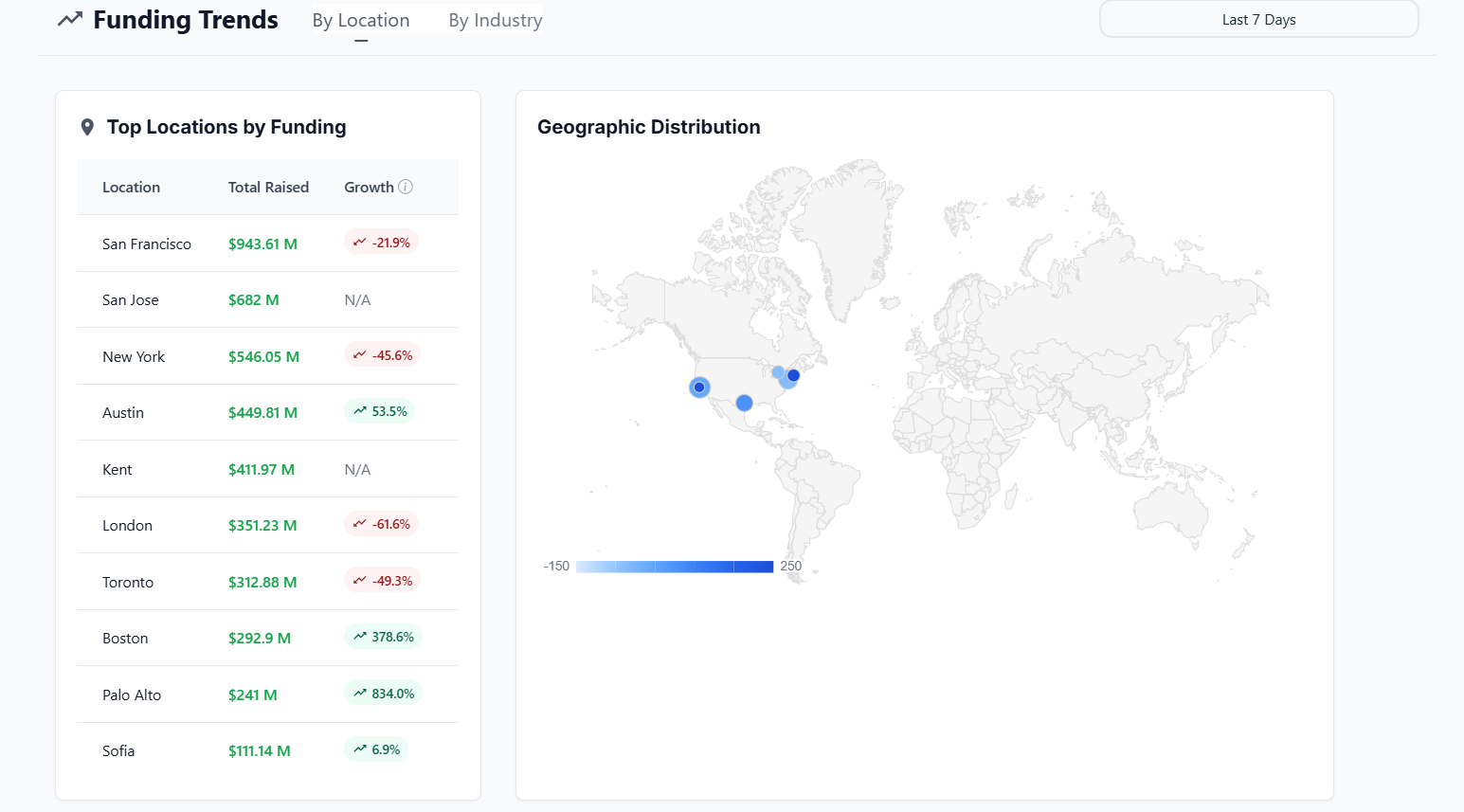

Over the past few years, innovative solutions in the financial industry have become widespread. One segment that took place in this direction is fundr...

%20lands%20$7M%20Seed%20to%20launch%20a%20global%20professional%20dance%20league.png)