Pre-Seed Funding:

Pre-seed funding is the initial capital from the Founders, friends & family to start and run the business. Pre-seed funding typically ranges from $50k - $250k.

Seed Funding: Description

Seed funding is the first investment in a startup company in exchange for equity/partial ownership of the company. Seed funding can come from a variety of sources, such as friends and family, Angel Investors, Crowdfunding and startup accelerators. The reason for seed money is to help startup founders test an idea to see if they can demonstrate some product/market fit. To get seed funding, it is really about networking as well as selling the dream and team. Seed funding varies widely from just tens of thousands of dollars to up to around $10 million. The equity given up in exchange for the seed funding is generally in the range of 10% - 25%.

Seed Funding: Average and Valuation

• Typical Seed Funding Ranges: $250k - $5 million.

• Average Seed Funding Startup Valuation: The pre-money valuation of a startup receiving seed funding is currently around $6 million.

Seed Funding: Investors

Some major sources of seed investors (beyond friends and family) include:

1. Angel Investors (Here is a listing of hundreds of Angel Groups around the world)

2. Accelerators like YCombinator and TechStars

3. Micro-VC's

4. Seed Funds from large corporations such as Intel, Google and FedEx, offer seed funding to promising startups working on innovative technologies which might be good acquisition candidates later.

A list of of the most active seed investors includes:

1. Startup-Chile

2. Hiventures

3. Crowdcube

4. Innovation Works

5. 500 Startups

6. Innova Memphis

7. Entrepreneurs Roundtable

8. Berkeley SkyDeck Fund

9. Quake Capital Partners

Series A Funding: Description

Series A funding, (also known as Series A financing or Series A investment) means the first venture capital funding for a startup. The Series A funding round follows a startup company's seed round and precedes the Series B Funding round. "Series A" refers to the class of preferred stock sold.

Receiving a Series A round is an important milestone for startup companies. Aside from the funding being much larger than a seed round, companies need to demonstrate they have a minimum viable product (MVP) to acquire an A round - and not just a great idea or team. It is not easy for seed funded companies to graduate to a Series A funding round.

In fact, less than 10% of companies that raise a seed round are successful in then raising a Series A investment. A Series A investment provides venture capitalists, in exchange for capital, the first series of preferred stock after the common stock issued during the seed round. Generally speaking, a Series A financing provides up to a couple of years of runway for a startup to develop its products, team and begin to execute on its go-to-market strategy.

Series A Funding: Average and Valuation

• Average Series A Funding (U.S. funding data): The mean Series A funding round has grown steadily over the years and ended 2021 at $22.2 million, up from $15.6 million in 2020, a 30% increase. As of 1/13/22, the mean Series A so far in 2022 is $25 million. [1]

In the U.S., the number of Series A deals as well as the mean round size increased significantly in 2021. There were approximately 880 Series A deals in the U.S. in 2021, an increase of 35% over the 650 Series A deals in the U.S. in 2020.

It is worth noting that the mean Series A is significantly higher than the median Series A. In 2021, the median early stage financing, which includes Series A & B, is around $8 million. The significant disparity between the mean and median exists because of an increasing amount of "mega-rounds", particularly among biotech startups.

• Average Series A Startup Valuation in 2021: Series A startups currently have a median pre-money valuation of around $24 million.

The Average Series A Funding page provides weekly updated averages and more detail on the current state of startup funding in the U.S. in 2020.

Series A Funding: Investors

While there are hundreds of venture capital firms in the U.S. alone (here is a listing of hundreds of VC firms), Some of the biggest Series A investors in software startups include Accel, 500 Startups, Bessemer Venture Partners, Andreessen Horowitz and Greycroft Partners.

A list of the most active Series A round, early stage investors also includes:

• IDG Capital

• New Enterprise Associates

• Sequoia Capital China

• Y Combinator

• ZhenFund

• Sequoia Capital

• Matrix Partners China

• Intel Capital

• Index Ventures

• Google Ventures

Pitchbook also cites these organizations as the most active investors in European Series A investments:

1. Idinvest Partners

2. High-Tech Gründerfonds

3. Octopus Ventures

4. Index Ventures

5. Partech Partners

How to Get Series A Funding:

1. Join an Accelerator

Approximately one-third of startups that raise Series A funding go through an accelerator[2] and the top 3 accelerators account for 10% of all Series A rounds[3]. The #1 factor evaluated for acceptance into leading accelerators is your team.[4]

2. Leverage Your Network

When fundraising, your network is critical. While joining a top-tier accelerator gives you the best statistical chance for success in ultimately getting a Series A funding, these groups only accept about 2% of applicants[5]. Startups that successfully raised a Series A without going this route often did so by networking early and often with influential investors, whether they are Angel Investors or VCs from leading venture capital firms.

3. Extend and Nurture Your Network

Continue to nurture and leverage angel and micro-VC connections before even thinking of pitching them. Take As many new meetings as You can. Building and nurturing genuine relationships before starting the Series A tour can dramatically improve your odds.

Series B Funding: Description

While a Series A funding round is to really get the team and product developed, a Series B Funding round is all about taking the business to the next level, past the development stage. Tomasz Tunguz, a well known Venture Capitalist at Redpoint, says a Series B funding is the most challenging round for a startup company.

Typically before Series B funding rounds occur, the company has to have shown some strong achievements after its Series A round. Series B is therefore to pour the gas on for growth with a larger investment round.

Series B Funding: Average and Valuation

• Average Series B Funding Amount: An analysis of 38 Series B deals in June, 2020, showed the mean Series B in the U.S. to be $33 million; the median was $26 million.

• Average Series B Startup Valuation in 2021: In 2021, Series B startups have a median pre-money valuation of around $40 million.

Series B Funding: Investors

A list of some of the top Series B investors includes:

• Google Ventures

• New Enterprise Associates

• Kleiner Perkins Caufield & Byers

• Khosla Ventures

• General Catalyst Partners

Series C Funding: Description

A Series C Funding Round generally occurs to to make the startup appealing for acquisition or to support a public offering. This is the first of what are called "later-stage" investments. This can continue into Series D funding, Series E funding, Series F funding, Series G funding, private equity funding rounds, etc. While there is a lot of capital ready, a lot of companies don't even make it to Series C. The reason for this is because Series C investors are looking for breakout companies that have already demonstrated significant traction. Thus, the deal size of Series C funding rounds has continued to increase.

Series C Funding: Average and Valuation

• Average Series C Funding Amount: An analysis of 14 Series C deals in the U.S. in June, 2020 showed the mean Series C round to be $59 million; the median was $52.5 million.

• Average Series C Startup Valuation: The median pre-money valuation of a startup receiving a Series C funding is currently around $68 million.

Series C Funding: Investors

Some of the most common investors in Series C funding include late-stage VCs, private equity firms, hedge funds and banks.

Equity Crowdfunding:

Equity crowdfunding portals allow individual users to invest in companies in exchange for equity. Typically on these platforms the investors invest small amounts of money, though syndicates are formed to allow an individual to take a lead on evaluating an investment and pooling funding from a group of individual investors.

Private Equity:

A private equity round is led by a private equity firm or a hedge fund and is a late stage round. It is a less risky investment because the company is more firmly established, and the rounds are typically upwards of $50M.

Convertible Note:

A convertible note is an ‘in-between’ round funding to help companies hold over until they want to raise their next round of funding. When they raise the next round, this note ‘converts’ with a discount at the price of the new round. You will typically see convertible notes after a company raises, for example, a Series A round but does not yet want to raise a Series B round.

Debt Financing:

In a debt round, an investor lends money to a company, and the company promises to repay the debt with added interest.

Secondary Market:

A secondary market transaction is a fundraising event in which one investor purchases shares of stock in a company from other, existing shareholders rather than from the company directly. These transactions often occur when a private company becomes highly valuable and early stage investors or employees want to earn a profit on their investment, and these transactions are rarely announced or publicized.

Grant:

A grant is when a company, investor, or government agency provides capital to a company without taking an equity stake in the company.

Corporate Round:

A corporate round occurs when a company, rather than a venture capital firm, makes an investment in another company. These are often, though not necessarily, done for the purpose of forming a strategic partnership.

Initial coin offering (ICO):

An initial coin offering (ICO) is a means of raising money via crowdfunding using cryptocurrency as capital. A company raising money through an ICO holds a fundraising campaign, and during this campaign, backers will purchase a percentage of a new cryptocurrency (called a “token” or “coin”), often using another cryptocurrency like bitcoin to make the purchase, in the hopes that the new cryptocurrency grows in value.

Post-IPO Equity:

A post-IPO equity round takes place when firms invest in a company after the company has already gone public.

Post-IPO Debt:

A post-IPO debt round takes place when firms loan a company money after the company has already gone public. Similar to debt financing, a company will promise to repay the principal as well as added interest on the debt.

Post-IPO Secondary:

A post-IPO secondary round takes place when an investor purchases shares of stock in a company from other, existing shareholders rather than from the company directly, and it occurs after the company has already gone public.

Non-Equity Assistance:

A non-equity assistance round occurs when a company or investor provides office space or mentorship and does not get equity in return.

Funding Round:

“Funding round” is the general term used for a round when information regarding a more specific designation of the funding type is unavailable.

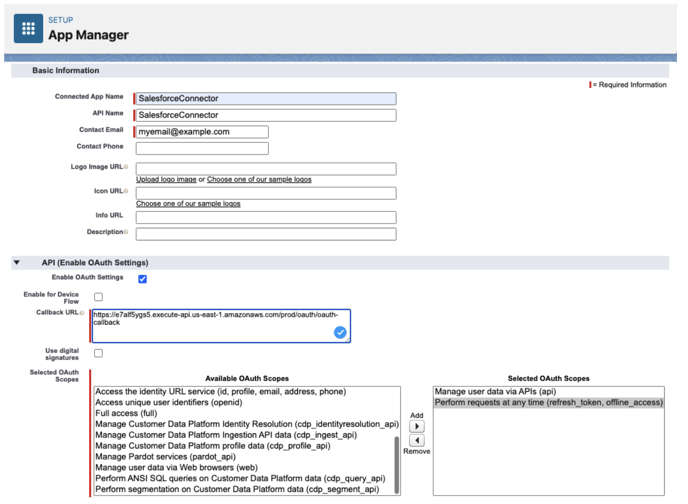

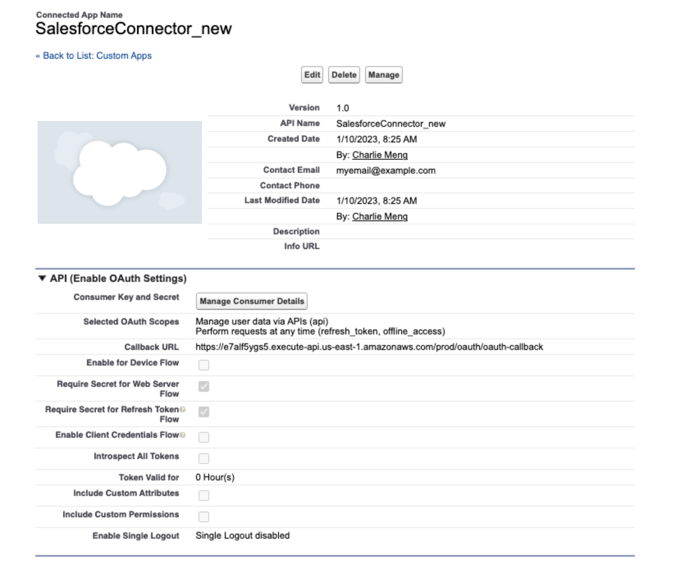

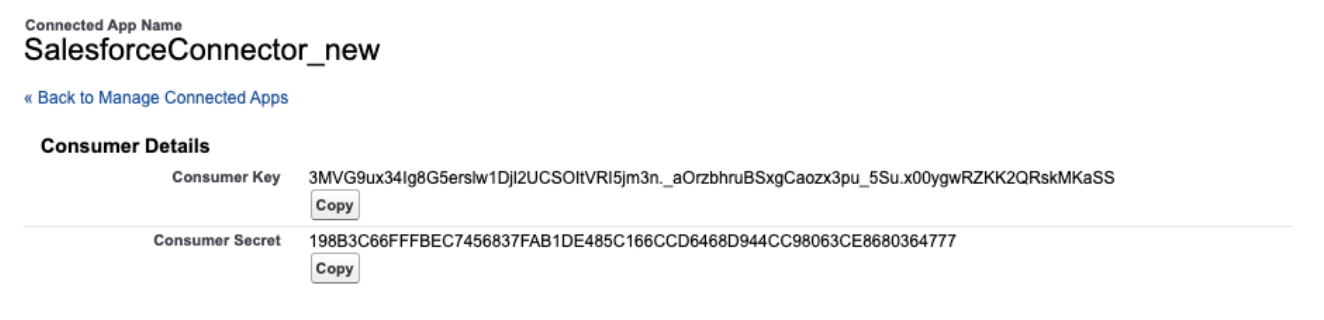

6. Save the consumer key and secret to enter in the Fundz app

6. Save the consumer key and secret to enter in the Fundz app

.png?width=265&name=Screen%20Shot%202022-07-28%20at%202.47.08%20PM%20(1).png)

.jpg?width=688&name=Screenshot%20of%20https___serene-lewin-a98446.netlify.app_fundings_149490%20(1).jpg)