Series A, B, C Funding: Averages, Investors, Valuations

Discover the Signals Behind the Fastest Growing Startups

Fundz monitors real-time fundings, executive moves, product launches & more — and delivers daily leads scored by AI. See which companies are moving today.

Try Fundz Free — See Today’s Signals →

Trusted by Top Sales Teams Worldwide

Table of Contents

- What is Series A Funding?

- Series B Funding: Description, Averages, Investors

- Series C Funding: Description, Averages, Investors

- Seed Funding: Description, Averages, Investors

- How to Best Track New Funding Rounds

- Funding Rounds and the Startup Financing Cycle: How it Works [Video]

- Related Resources

- References

What is Series A Funding?

Series A funding, (also known as Series A financing or Series A investment) means the first venture capital funding for a startup. The Series A funding round follows a startup company's seed round and precedes the Series B Funding round. "Series A" refers to the class of preferred stock sold.

Receiving a Series A round is an important milestone for startup companies. Aside from the funding being much larger than a seed round, companies need to demonstrate they have a minimum viable product (MVP) to acquire an A round - and not just a great idea or team. It is not easy for seed funded companies to graduate to a Series A funding round.

In fact, less than 10% of companies that raise a seed round are successful in then raising a Series A investment. A Series A investment provides venture capitalists, in exchange for capital, the first series of preferred stock after the common stock issued during the seed round. Generally speaking, a Series A financing provides up to a couple of years of runway for a startup to develop its products, team and begin to execute on its go-to-market strategy.

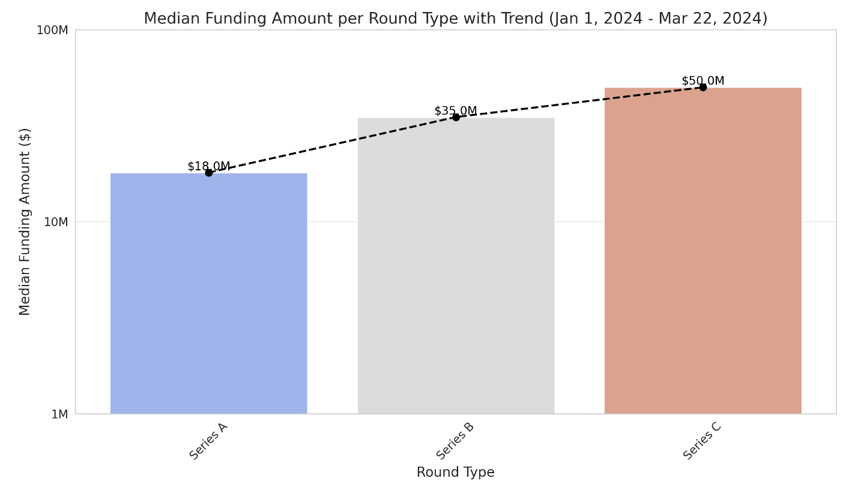

Average Series A, B, C Funding, Q1 2024 (Median)

• Series A rounds in the U.S, have a median funding amount of $18 million

• Series B rounds in the U.S. have a median of $35 million

• Series C rounds in the U.S. have a median of $50 million

Series A Funding: Investors

While there are hundreds of venture capital firms in the U.S. alone (here is a listing of hundreds of VC firms), Some of the biggest Series A investors in software startups include Accel, 500 Startups, Bessemer Venture Partners, Andreessen Horowitz and Greycroft Partners.

A list of the most active Series A round, early stage investors also includes:

• IDG Capital

• New Enterprise Associates

• Sequoia Capital China

• Y Combinator

• ZhenFund

• Sequoia Capital

• Matrix Partners China

• Intel Capital

• Index Ventures

• Google Ventures

Pitchbook also cites these organizations as the most active investors in European Series A investments:

1. Idinvest Partners

2. High-Tech Gründerfonds

3. Octopus Ventures

4. Index Ventures

5. Partech Partners

How to Get Series A Funding:

1. Join an Accelerator

Approximately one-third of startups that raise Series A funding go through an accelerator[2] and the top 3 accelerators account for 10% of all Series A rounds[3]. The #1 factor evaluated for acceptance into leading accelerators is your team.[4]

2. Leverage Your Network

When fundraising, your network is critical. While joining a top-tier accelerator gives you the best statistical chance for success in ultimately getting a Series A funding, these groups only accept about 2% of applicants[5]. Startups that successfully raised a Series A without going this route often did so by networking early and often with influential investors, whether they are Angel Investors or VCs from leading venture capital firms.

3. Extend and Nurture Your Network

Continue to nurture and leverage angel and micro-VC connections before even thinking of pitching them. Take As many new meetings as You can. Building and nurturing genuine relationships before starting the Series A tour can dramatically improve your odds.

Series B Funding: Description

Series A vs. Series B. While a Series A funding round is to really get the team and product developed, a Series B Funding round is all about taking the business to the next level, past the development stage. Tomasz Tunguz, a well known Venture Capitalist at Redpoint, says a Series B funding is the most challenging round for a startup company.

Typically before Series B funding rounds occur, the company has to have shown some strong achievements after its Series A round. Before scaling your startup, it’s essential to test your concept thoroughly. SapientPro`s PoC development services help you demonstrate real-world applications, giving you the confidence to move forward. Series B is therefore to pour the gas on for growth with a larger investment round.

Series B Funding: Investors

A list of some of the top Series B investors includes:

• Google Ventures

• New Enterprise Associates

• Kleiner Perkins Caufield & Byers

• Khosla Ventures

• General Catalyst Partners

Series C Funding: Description

A Series C Funding Round generally occurs to to make the startup appealing for acquisition or to support a public offering. This is either the last early stage VC funding or the first of what are called "later-stage" investments, depending on who you ask. Venture rounds can continue into Series D funding, Series E funding, Series F funding, Series G funding, private equity funding rounds, etc. While there is a lot of capital ready, a lot of companies don't even make it to Series C. The reason for this is because Series C investors are looking for breakout companies that have already demonstrated significant traction. Thus, the deal size of Series C funding rounds has continued to increase.

Seed Funding: Description

Seed funding is the first investment in a startup company in exchange for equity/partial ownership of the company. Seed funding can come from a variety of sources, such as friends and family, Angel Investors, Crowdfunding and startup accelerators. The reason for seed money is to help startup founders test an idea to see if they can demonstrate some product/market fit. To get seed funding, it is really about networking as well as selling the dream and team. Seed funding varies widely from just tens of thousands of dollars to up to around $10 million. The equity given up in exchange for the seed funding is generally in the range of 10% - 25%.

Seed Funding: Average and Valuation

• Average Seed Funding Amount in 2020: $2.2 million.

• Average Seed Funding Startup Valuation: The pre-money valuation of a startup receiving seed funding is currently around $6 million.

Seed Funding: Investors

Some major sources of seed investors (beyond friends and family) include:

1. Angel Investors

2. Accelerators like YCombinator and TechStars

3. Micro-VC's

4. Seed Funds from large corporations such as Intel, Google and FedEx, offer seed funding to promising startups working on innovative technologies which might be good acquisition candidates later.

A list of of the most active seed investors includes:

1. Startup-Chile

2. Hiventures

3. Crowdcube

4. Innovation Works

5. 500 Startups

6. Innova Memphis

7. Entrepreneurs Roundtable

8. Berkeley SkyDeck Fund

9. Quake Capital Partners

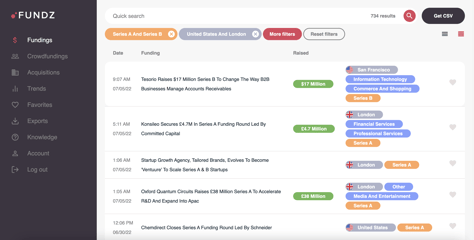

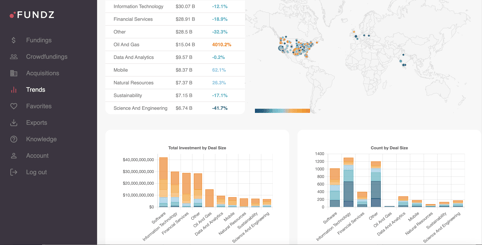

How to Best Track New Funding Rounds

With a Fundz account, you get real-time updates of companies that have announced new funding, an acquisition or are seeking funding via crowdfunding. Fundz also integrates executive contact and company data. Pro customers can also exports to CSV (sample) and can see real-time trends data on the top worldwide locations and industries currently receiving funding, with number of deals and total investment per industry and top location. Both the interface and pricing are the best on the market.

Related Resources:

Regulation Considerations When Raising Startup Funding

What is a Series A Funding Term Sheet?

Discover the Signals Behind the Fastest Growing Startups

Fundz monitors real-time fundings, executive moves, product launches & more — and delivers daily leads scored by AI. See which companies are moving today.

Try Fundz Free — See Today’s Signals →

Trusted by Top Sales Teams Worldwide

Our Quickly Growing Customer Base

Great product! I got a few sizeable contracts through Fundz, so made a video to recommend your service for my followers.

Caleb Lai, Alphaio

Just wanted to let you know I love the product and leverage Fundz along with the chrome extension every day - love it!

Caroline White - Sales Process & Productivity, Cloudflare

Fundz has been a great tool that I recommend to others.

Tony Mai - Corporate Account Executive, Snowflake