The Role of Financial Technology (FinTech) in Modern Fundraising

Over the past few years, innovative solutions in the financial industry have become widespread. One segment that took place in this direction is fundr...

Over the past few years, innovative solutions in the financial industry have become widespread. One segment that took place in this direction is fundr...

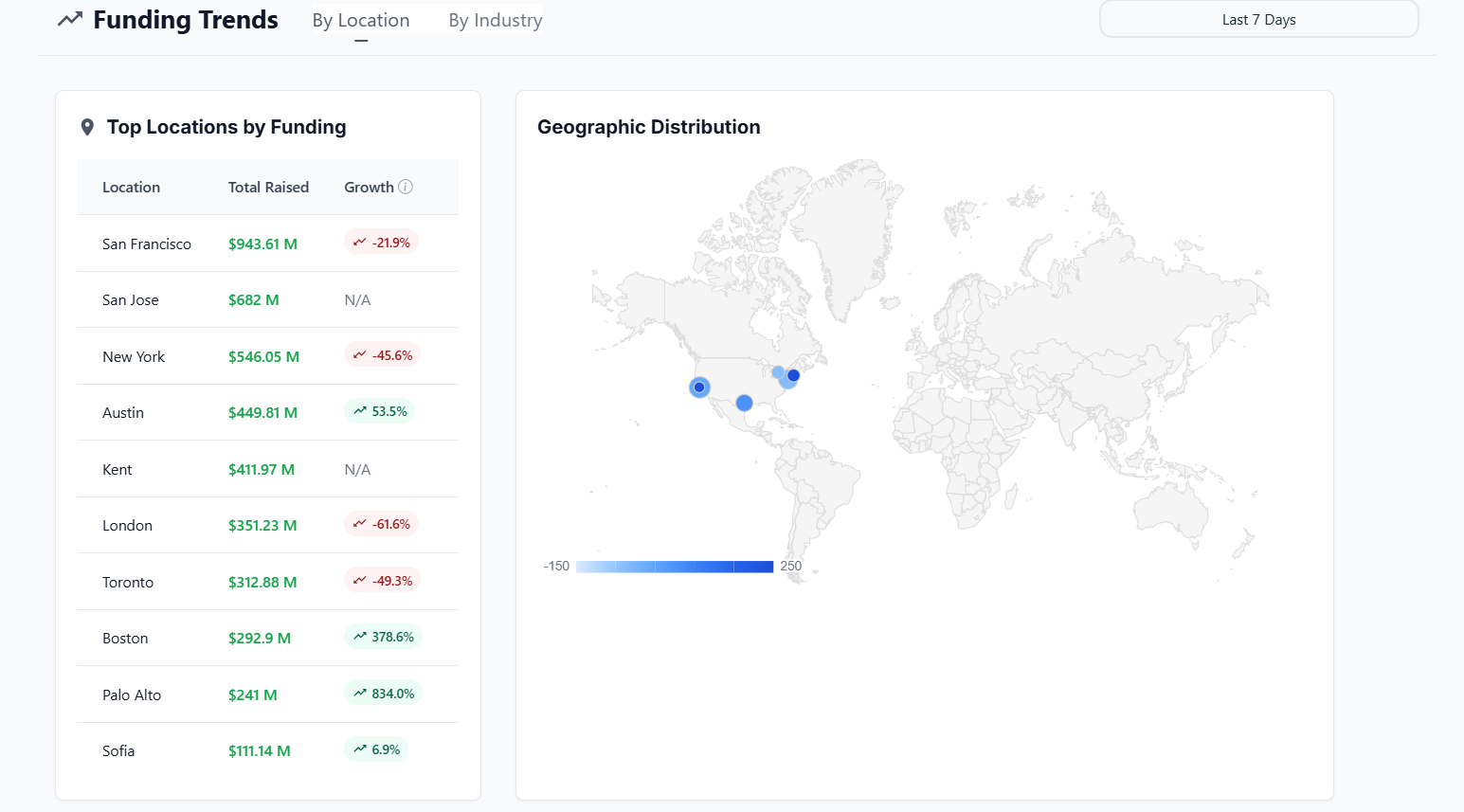

The first two weeks of 2026 did not shout; they spoke clearly. Fundz recorded $1.87B across 126 anno...

Voice technology has moved beyond smart speakers and basic IVR menus. In many companies, voice is be...

%20lands%20$7M%20Seed%20to%20launch%20a%20global%20professional%20dance%20league.png)