The Remote Work Struggles Growing Businesses Face and How to Manage Them

Remote work has become a core part of how many growing companies operate. It offers flexibility, helps businesses hire beyond their local market, and ...

Remote work has become a core part of how many growing companies operate. It offers flexibility, helps businesses hire beyond their local market, and ...

Here's a harsh truth: most futures traders flame out before their first anniversary in the markets. ...

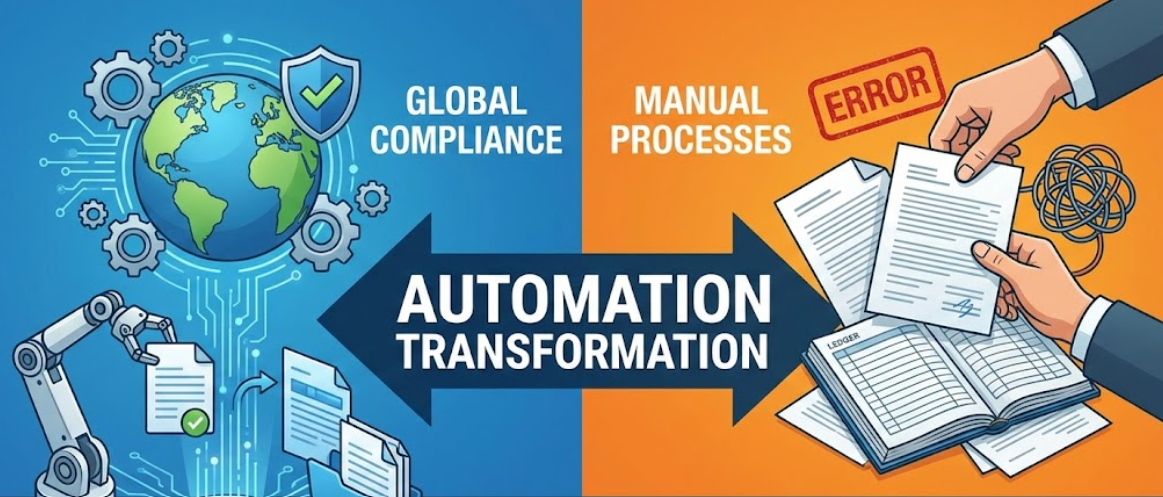

Business compliance is an area often overlooked when implementing automation in the workplace. Compl...